My Credit Repair Journey…

First, unlike other websites, Credit4everyone is built upon my own credit rating. I won't bore you with long winded details but I will tell you that everything was going well and due to a change of circumstances, things started falling into arrears and before I knew it, my credit rating was damaged for a minimum of six years.

First, unlike other websites, Credit4everyone is built upon my own credit rating. I won't bore you with long winded details but I will tell you that everything was going well and due to a change of circumstances, things started falling into arrears and before I knew it, my credit rating was damaged for a minimum of six years.

You see, a missed payment here and there isn't bad, after a while it can easily be over looked by any lenders. However, when things get serious, these non payments result in debt collectors and defaults.

That's when the trouble really kicks in. We was Hassled by letters, calls from debt collection agencies. One of the biggest issues for Defaults, especially on Mobile phones for example, is the full contract becomes payable, meaning a £50 bill can spiral to £1000+ which makes it impossible to resolve.

So after a change in our circumstances in 2011, we ended up with many defaults and that's our credit rating shot apart for six years. We tried to resolve issues in 2012 and 2013 which even results in a couple of new defaults. It's an ever ending circle.

One day in 2013, I made it my mission to resolve my issues, I sat down, did a budget and have managed for the past two years to keep all my repayments (excluding the defaults) up to date, I was quiet lucky, I managed to keep up repayments on one Credit Card, Capital One (it only has a £300 limit) but it's a credit card.

As I said, once I woke up with the intention of rebuilding my credit rating, I had to look at my credit report and see just what the damage was. It was horrible logging in for the first time and having to look through the dreaded Red Defaults on many accounts, but my intention here was to start repairing the damage. I took a note of everything without a default and for over 2 years I have kept up those repayments without fail.

What I had on my Credit file to work on…

All reporting my repayments to my Credit file. I had an incredible 18 defaults by now, all with dates ranging from 2010 through to 2013, this means even if I was to make full payments on the accounts, my credit file will not be totally clear from this time in my life until at least 2019!

Now it's easy to give up totally and let these accounts go into default, but I wanted as I said above, to start the rebuilding process. Now on paper, this looks terrible, 19 defaults and just 4 good accounts to work on. It must surely be impossible to turn things around, well I do like a good challenge so I did.

In 2013, April we moved and I set my challenge of never missing a repayment again. I updated my address on my Capital One and Barclays account and with Virgin Media and for the first few weeks I had peace as the Debt Collectors didn't have my address, but things changed pretty quickly, after updating my address with the Credit Reference agencies, they managed to track down my new address and the letters returned.

That said, I wasn't going to let that put me off and I kept up those repayments for 1 whole year, the other items are in default anyway, so are not going to cause me any further damage.

April 2014 Getting accepted for a FULL current account (well 5 actually) after keeping up repayments for just 12 months…

In April 2014 I decided to take the plunge and make some applications, after all I have read on many forums that there are products and services that can help people in my position, so I applied for a Current account with TSB, once I hit the Submit button I did think to myself, this was going to easily be declined, but to my surprise, it was accepted.

I remember getting a nice feeling thinking things must have improved, so I was a little silly, I went along and opened up a few current accounts, Lloyds (classic, Club Lloyds) and Halifax (oh and Bank of Scotland). These are all full current accounts, not the cash card accounts. Halifax and Bank of Scotland even provided the debit cards with the Contactless payment method, Lloyds and TSB offer these on their accounts, but I was giving debit cards without the feature. These bank accounts are all Visa Debit cards and have online access but that's about it.

I did try for a cheeky overdraft, after all any borrowing at all when rebuilding a credit rating is going to help, but my application got referred and I was asked to call, so I did, the guy on the phone said to hold whilst he went and took a look, he came back and reminded me pretty swiftly about my problems, he said I should take a look at my Credit Report.

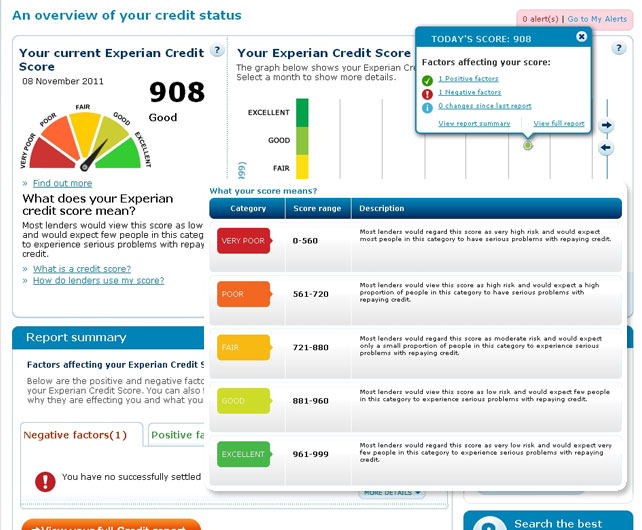

So no overdraft but I now had 5 new Bank accounts, Halifax, Club Lloyds, Lloyds Classic, TSB and Bank of Scotland. I decided to close down my Barclays cash card that I had for about 8 years as I now had a full current account rather than a cash account. So armed with 5 new current accounts, I noticed my Credit Score provided by Experian (credit expert) dropped a lot.

I know you shouldn't take a massive amount of notice about this score, but I use it to see how well I am doing, my score had by now hit 54 (I think I was on about 120) before this.

May 2014

Now 2 months later, I wanted to get that nice feeling about being accepted again, but in the back of my mind, those defaults worth about £25,882 were also worrying me.

I decided one application won't hurt so I plunged for a an application with EE, (iPhone 5S) which was the top of the range back in June 2014, I put all my details in and pressed Submit. It wasn't an instant decision so I went on with my day and basically forgot all about it until later that evening. To my actual shock, I was approved.

The phone arrived and I was totally amazed about this as you can imagine (especially as I had arrears with Orange) but still. I have always been a fan of Apple products and wanted an iPad but I wondered if I could try another company. I looked around (couldn't touch Vodafone) as I had a default to the sum of £6k on my credit file, I took to looking at O2.

I looked online and some people with poor credit had success whilst others hadn't, so I did what I do and fired an application in and to my amazement it was approved.

That's 5 current accounts and 2 new mobile phones all from keeping up the repayment on 4 products after 16 of my credit agreements fell into default.

It felt amazing and good inside to know I can do this and set me up to keep up with my work and to go from the lows to gaining back my credit rating.

My credit score on both Equifax and Experian were still Very Poor and totally accepted but I did wonder why I was being approved for Current Accounts and Mobile phones.

With o2 for example, it had a double benefit, it shows on your credit file as a Communication and a second entry for the loan. You see, they total the cost of the iPad and do that as a Loan, which means I get Double (0) green ticks for keeping up the repayments and I show I can manage a loan as well as a Contract.

Now don't get me wrong, I think this is wonderful now, if I do happen to Slip up, I imagine get hit twice with a (1) or Yellow missed payment marker is going to do double the damage.

August and it's Tesco, Aqua and Ocean Credit Card

So we are having a family holiday at the end of August and I have managed to keep up the repayments on my new contracts for a couple of months, all other repayments are fine and made on time and my past 15 months are all showing Green ticks, would I be able to get a Credit Card?

I take the plunge, after all I am finding this to be a little easier than expected so far, I would never of guessed I could get accepted for a full current account, let alone 5, or, a sim only deal let alone an Apple iPad Air and iPhone 5s, (without deposit).

So I find out that Tesco have launched a new Credit Card, it's called the Tesco Foundation Card, it's slightly confusing, on the home page, it mentions it's for those new to credit, on the application form it's for those showing some signs of managing credit lately, so I go ahead, enter my information, again I am in for a total shock, on hitting Apply now, I am greeted with a message that says my Credit Offer, £600 credit limit subject to final checks, brilliant I think.

I head over to Aqua and I complete an application, similar thing happens there, this time rather than an offer of a credit card with a credit limit, I am greeted with a message that my APR would be 59.9%, that's fine, it's a credit card and my Capital One only has £300 despite being opened in 2008, I go ahead and tick the boxes, I then go straight over to Ocean.

Now Ocean credit cards are actually Capital One Cards under a different cover, but still it's new and you can hold a Capital One and Ocean credit card so I think to myself let's try.

A week passes and no letters or cards arrive and one week becomes two. So I call up! Aqua tell me that my application is with them and I will know shortly.

Tesco tell me that a letter has been posted to me with more details.

The very next day (sods law) I receive a letter from Ocean saying I didn't pass the credit score, the same happens from Tesco, so I am now clutching on with Aqua. That great feeling of being accepted starts to become a much distant memory.

A few days later I get a Sorry, After consideration… from Aqua…

Was it due to too many credit applications in the past 6 months? Was it a fluke to get accepted before? Was it the fact that I did have a terrible credit rating and each company will make their own decision based upon their own credit score card.

Of course, I will never know the actual reason that made them say no, but the truth is, I am guessing the amount and the number of defaults was 99% of their decision.

Our holiday was great (thanks for thinking about that) in September the new Apple iPhone 6 is out and I am a mug for an iPhone. I wonder if I can ask for a new (second line) so fingers crossed I called o2. they said Yes, on a deposit of £250, after a holiday, I don't have that kind of money, so it's a no from me.

I try EE, to my surprise it's a Yes, my partner then asks, begs and pretty much gives me the look that wins every time, but in all honesty, EE pricing is high, over £60 a month, if I am to continue my program and not miss a repayment ever for 6 years, I have to think about this.

I decide to opt for Virgin Mobile, they do great deals, now Virgin Mobile are a little harder to convince, I have been with them for 4 years but they use their own credit scoring system and I am a 2 and not a 1, what ever that means, but he pulls strings and I am told the order goes through.

It does and I now own a second iPhone 6 plus.

I am still thinking to myself, it would be good to grab a little Credit Card so I have a cheeky application in October, it's a No from Vanquis (not surprised they were one of those I had a default with, but I have heard) that they can re-take you on. Capital One did in 2008 after I messed up in around 2003 time so it was worth a try.

So in 2014, I managed to keep up with all of my repayments, no missed payments and I am starting to build a nice little pattern of Green ticks (so much nicer than those red defaults). A long way to go, but I am first gear.

I worked out that my last default has the wrong date on it, but don't worry, I will get that sorted eventually, right now, it's not going to make any difference what so ever, my aim is simply to be Credit Worthy by 2019 and I am on track. It's been 19 months without a missed repayment and I have 5 current accounts, 3 new mobile phones on contract and the 4 original agreements on my credit file, thats a total of 12 agreements all reporting back my repayments, hopefully 2015 will continue the same way 🙂